Upptäck inlägg

Utforska fängslande innehåll och olika perspektiv på vår Upptäck-sida. Upptäck nya idéer och delta i meningsfulla samtal

Buy LinkedIn Account

#buy_linkedin_account

https://topusapva.com/product/....buy-linkedin-account

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo

Look Youthful with Fillers in Gurgaon

Achieve a rejuvenated and youthful appearance with expertly applied fillers in Gurgaon. Dermal fillers are perfect for adding volume, reducing wrinkles, and enhancing facial features like lips and cheeks. Administered by trained professionals, these non-surgical treatments provide immediate, natural-looking results with minimal downtime. Clinics in Gurgaon use high-quality, FDA-approved products for safe, long-lasting outcomes. Whether you're looking to smooth fine lines or contour your face, fillers offer a quick and effective solution tailored to your beauty goals.

Visit us: https://www.sculptindia.com/gu....rgaon/fillers-treatm

Buy WebMoney Accounts

#buy_verified_webmoney_accounts

https://topusapva.com/product/....buy-webmoney-account

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo

Buy Perfect Money Accounts

#buy_verified_perfect_money_accounts

https://topusapva.com/product/....buy-perfect-money-ac

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo

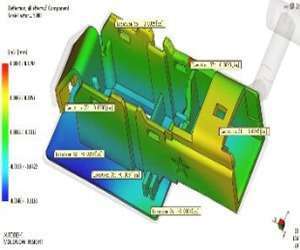

Precision Moldflow Service for Plastic Injection Molding Optimization

Improve your manufacturing outcomes with precision Moldflow Service provided by feamax.com. We deliver in-depth analysis of mold designs to predict flow patterns, shrinkage, warpage, and other factors, enabling you to produce defect-free parts while saving time and reducing material waste.

Visit Us:- https://www.feamax.com/moldflow-analysis/

Buy Verified Neteller Accounts

#buy_verified_neteller_accounts

https://topusapva.com/product/....buy-verified-netelle

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo

Singapore Online Casino | 3weasia.com

Visit 3weasia.com to feel the rush of the Singapore Online Casino, complete with exciting games and amazing incentives. Join now!

https://3weasia.com/casino/

Buy Verified Payeer Accounts

#buy_verified_payeer_accounts

https://topusapva.com/product/....buy-verified-payeer-

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo

Buy Verified Coinbase Account

#buy_verified_coinbase_account

https://topusapva.com/product/....buy-verified-coinbas

If you need any more services—-

Contact Us :

Email: topusapva@gmail.com

WhatsApp: +1 (281) 323-0508

Telegram: topusapva Binance

Skype: topusapva Binance

#topusapva #seo #digitalmarketer #usaaccounts #seoservice #socialmedia #contentwriter #on_page_seo #off_page_seo