In the dynamic realm of e-commerce, merchants constantly strive to streamline operations, enhance customer experiences, and maximize revenue. However, amidst these ambitions, chargebacks emerge as a significant challenge, impacting profitability and operational efficiency. To navigate this landscape effectively, merchants turn to innovative solutions like chargeback resolution software.

Understanding the Challenge of Chargebacks

Chargebacks represent a common occurrence in online transactions, initiated by consumers disputing a charge with their issuing bank. While they serve as a consumer protection mechanism, excessive chargebacks can burden merchants, leading to revenue loss, increased operational costs, and reputational damage.

In this scenario, merchants often find themselves in a precarious position, grappling with the complexities of chargeback management. The traditional approach to resolving chargebacks involves manual intervention, consuming valuable time and resources. Moreover, without proactive measures in place, merchants may face an uphill battle in representing chargebacks effectively.

Empowering Merchants with Chargeback Software

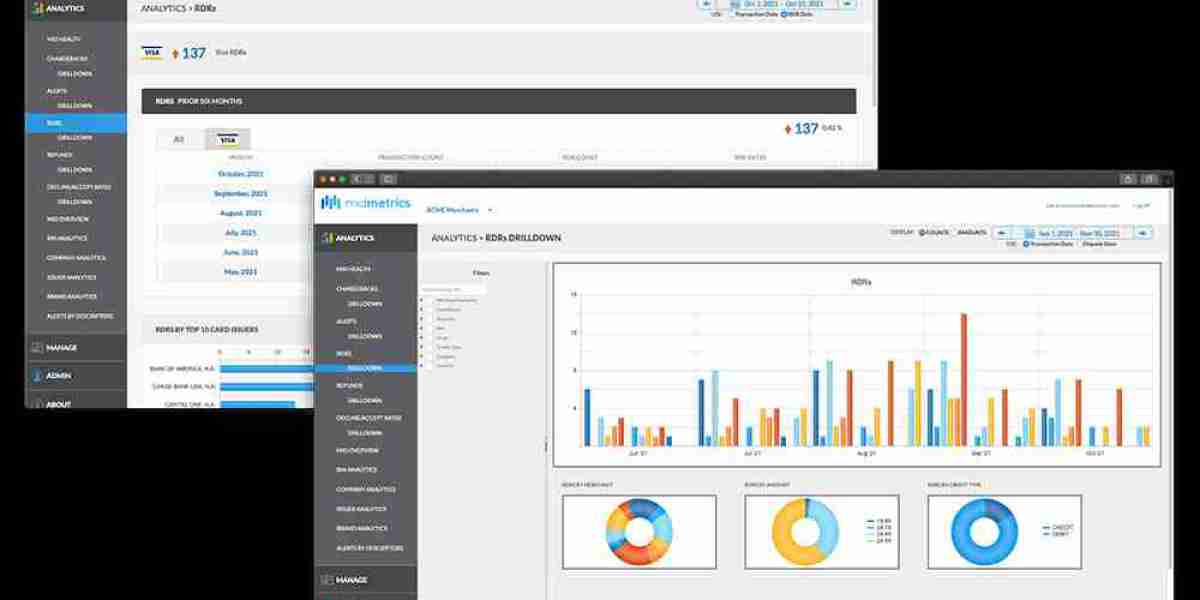

Amidst these challenges, chargeback software emerges as a beacon of hope for merchants, offering a robust toolkit to address the complexities of chargeback management. By leveraging advanced algorithms and real-time analytics, chargeback software equips merchants with actionable insights into transaction disputes, enabling swift and informed decision-making.

The capacity to automate and simplify the chargeback representation process is a major benefit of chargeback software. Through intelligent automation, merchants can efficiently gather evidence, construct compelling cases, and submit representations, thereby improving the likelihood of successful outcomes.

Enhancing Operational Efficiency

In addition to facilitating chargeback representation, chargeback software plays a pivotal role in enhancing operational efficiency across the board. By centralizing chargeback management activities within a unified platform, merchants can streamline workflows, minimize manual errors, and optimize resource allocation.

Furthermore, Software for charging back empowers merchants with proactive alerting mechanisms, notifying them of potential chargeback triggers in real-time. Armed with this foresight, merchants can take pre-emptive measures to mitigate risks, address underlying issues, and prevent chargebacks before they escalate.

The Path Forward with MidMetrics

In the quest for effective chargeback management, merchants seek reliable partners who can provide tailored solutions to meet their unique needs. One such partner is MidMetrics, a leading provider of merchant account analytics and payment technology solutions.

MidMetrics provides a full range of analytics and solutions for chargebacks, with the goal of optimizing operational costs, increasing acceptance rates, and removing payment bottlenecks. With its chargeback resolution software, merchants can navigate the complexities of chargeback management with ease, while unlocking new levels of efficiency and profitability.

Conclusion:

Chargeback resolution software represents a game-changing solution for merchants grappling with the challenges of chargeback management. By harnessing the power of automation, analytics, and proactive alerting, merchants can mitigate risks, enhance operational efficiency, and drive sustainable growth in the e-commerce landscape.

For more information about chargeback resolution software and other payment technology solutions, visit MidMetrics.com today.