London

Roots Analysis has announced the addition of “Antibody Discovery Services and Platforms Market (4th Edition) Market, 2021-2035” report to its list of offerings.

Given the complexity associated with the development of antibody-based biologics, many drug developers are now seeking to optimize RD efficiency and affiliated costs. As a result, innovator companies are outsourcing most of their discovery-stage operations to specialty contract research organizations (CROs), that offer a plethora of advanced technologies to cater to the evolving needs. It is also worth highlighting that the stakeholders engaged in this domain are actively undertaking initiatives to develop interventions for different variants targeting COVID-19.

Key Market Insights

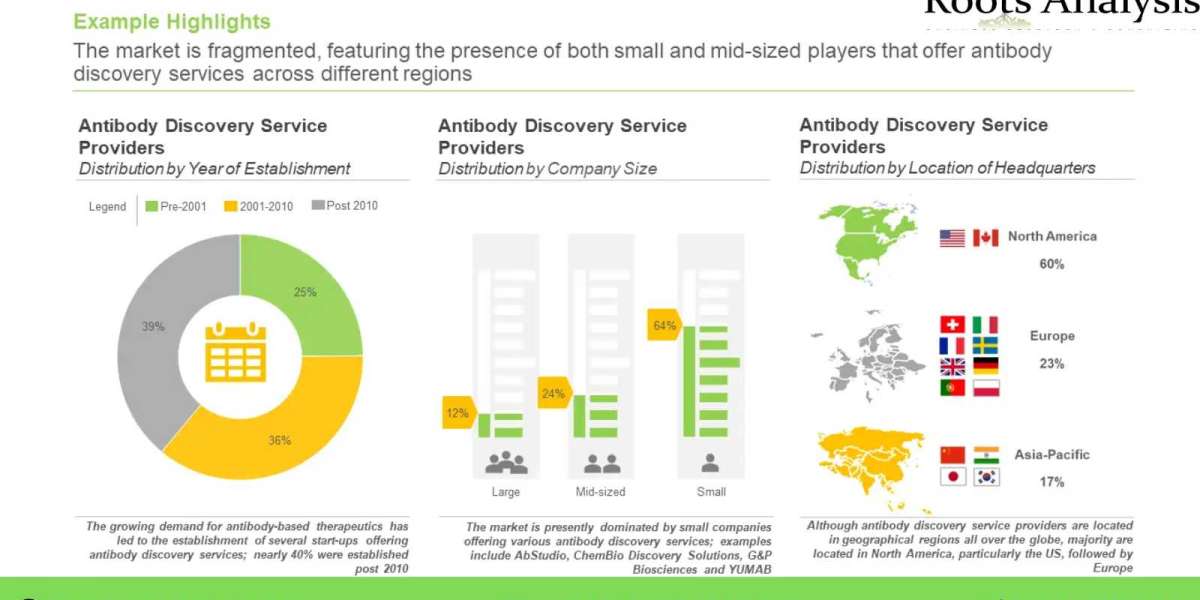

Around 140 companies presently offer antibody discovery services

Over 90% of the aforementioned players provide services for hit generation, followed by those offering services for antigen designing (57%). It is worth mentioning that eleven service providers claim to have the expertise required to serve as one-stop-shops for all the antibody discovery steps.

More than 150 companies offer antibody discovery platforms

It is worth highlighting that more than 200 technologies focused on antibody discovery are presently available in the market. Further, nearly 50% platforms use library-based methods to discover antibodies. Amongst these, phage display is the most widely used technique, followed by single cell-based methods (30%).

Partnership activity in this field has increased at a CAGR of nearly 25%, between 2015 and 2021

More than 650 agreements were inked related to antibody discovery, since2015, with the maximum activity being reported in 2020. Majority of the deals were product development and commercialization agreements (21%), licensing agreements (20%) and RD agreements (19%).

More than USD 10 billion has been invested by both private and public investors, during 2016-2021

The aforementioned amount was raised across more than 200 funding instances. Of the total amount invested, USD 4.2 billion was raised through venture capital financing, representing 41% of the overall funding activity in this domain. Further, nearly 60 instances of grants were reported, wherein players collectively received more than USD 990 million.

North America and Europe are anticipated to capture 77% share (in terms of service revenues) of the market, in 2035

Among the various methods used by service providers for development of antibodies, majority of the market opportunity (60%) for antibody discovery services is likely to be generated from phage display and hybridoma based methods. On the other hand, for methods utilizing transgenic animals, the opportunity is anticipated grow at a faster annualized rate (6.6%) owing to their ability to generate fully human antibodies with high affinities

The licensing market opportunity for antibody discovery platforms is anticipated to grow at a CAGR of close to 21%, during 2021-2035

By 2035, North America is estimated to capture over 50% (in terms of revenues generated) share of the antibody discovery platforms market. It is worth mentioning that the market for antibody discovery platforms in Asia-pacific is anticipated to grow at a relatively faster pace, during the forecast period.

To request a sample copy / brochure of this report, please visit https://www.rootsanalysis.com/reports/213/request-sample.html

Key Questions Answered

- Who are the leading industry players involved in offering services and technologies related to antibody discovery?

- What is the relative competitiveness of the players offering services related to antibody discovery, based across different geographies?

- What is the relative competitiveness of the technologies pertaining to antibody discovery across different peer groups?

- What kind of partnership models are commonly adopted by industry stakeholders engaged in the antibody discovery services and platforms domain ?

- Which key investors are likely to drive the antibody discovery services and platforms market?

- How is the current and future market opportunity likely to be distributed across key market segments?

The financial opportunity within the antibody discovery services market has been analyzed across the following segments:

- Steps Involved in the Antibody Discovery Process

- Antigen Designing

- Hit Generation

- Lead Selection

- Lead Optimization

- Lead Characterization

- Methods Used for Antibody Discovery

- Phage Display

- Hybridoma

- Transgenic Animal

- Yeast Display

- Single Cell

- Others

- Nature of Antibody Generated

- Humanized

- Human

- Chimeric

- Murine

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North America

The financial opportunity within the antibody discovery platforms market has been analyzed across the following segments:

- Type of Payment

- Upfront Payments

- Milestone Payments

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

The research includes detailed profiles of the key players (listed below) engaged in offering services related to antibody discovery; each profile features an overview of the company, its financial information (if available), details on services offered, recent developments, and an informed future outlook.

- Abveris Antibody

- AbgeneX

- Abwiz Bio

- Abzena

- Aragen Bioscience (Formerly GVKB Biosceinces)

- BIOTEM

- Capralogics

- ChemPartner

- Creative Biolabs

- Detaibio Tech

- FairJourney Biologics

- Fusion Antibodies

- ImmunoPrecise Antibodies

- Integral Molecular

- LakePharma

- ProteoGenix

- PX’Therapeutics

- RD-Biotech

- Syd Labs

- Viva Biotech

- WuXi Biologics

The research includes detailed profiles of the key players (listed below) engaged in offering technologies for antibody discovery; each profile features an overview of the company, its financial information (if available), details on technologies offered, recent developments, and an informed future outlook.

- Ablexis

- Creative Biolabs

- Genmab

- Harbour Biomed

- Immunome

- ImmunoPrecise antibodies

- Isogenica

- Kymab

- Ligand Pharmaceuticals

- Morphosys

For additional details, please visit

https://www.rootsanalysis.com/reports/view_document/antibody-discovery-services-and-platforms-market/213.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Flow Cytometry Service Market, 2022-2035

- Gene Editing beyond CRISPR Market, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415