Introduction

Are you looking to enhance your trading learning and become a successful day trader? The fast-paced world of day trade training requires a solid understanding of market strategies, risk management, and execution skills. Whether you're new to day trading for beginners or looking to refine your approach, this guide will help you navigate the markets effectively.

Why Day Trading?

Day trading offers traders the opportunity to capitalize on short-term price movements. Unlike traditional investing, which focuses on long-term growth, day trading involves quick decision-making, technical analysis, and strategic execution. However, becoming a profitable trader requires discipline, risk management, and continuous learning.

Key Elements of Day Trading Success

Market Selection – Different asset classes, including stocks, forex, and derivatives, offer unique opportunities. Understanding market dynamics is crucial for profitability.

Trading Strategies – Various strategies, such as scalping, momentum trading, and breakout trading, cater to different market conditions. Selecting the right approach is essential.

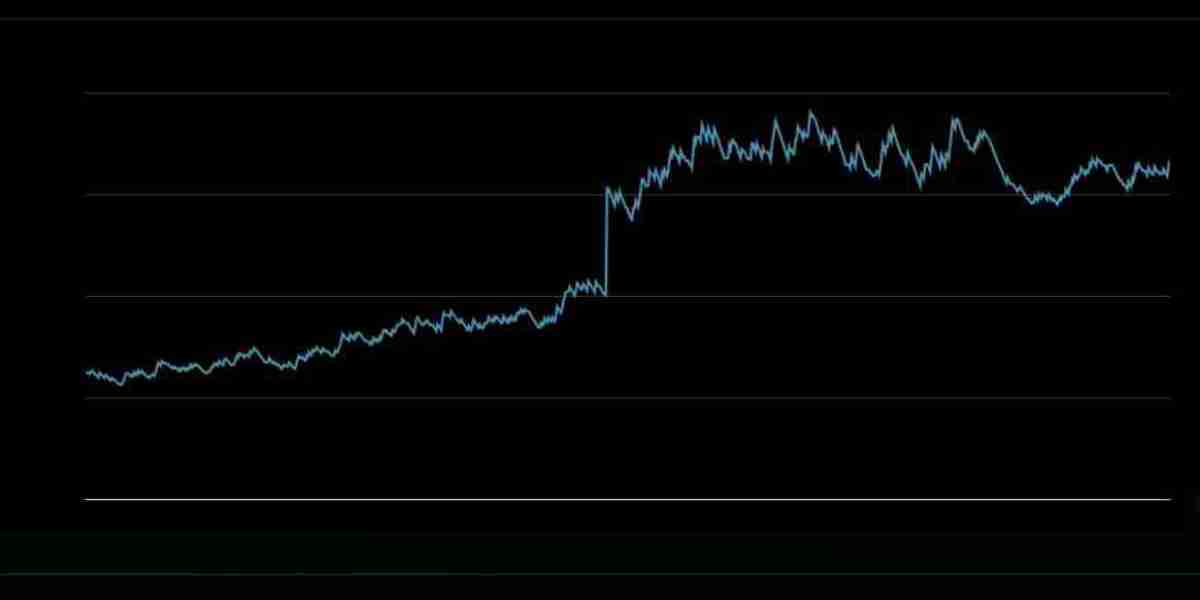

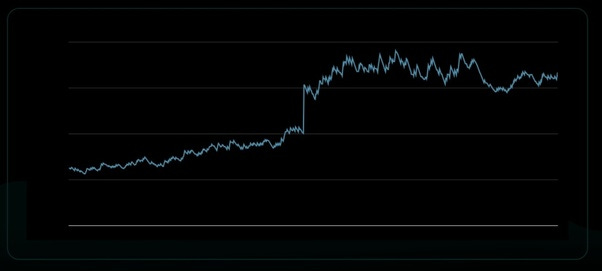

Backtesting – Testing strategies against historical data helps refine techniques and improve decision-making.

Capital and Risk Management – Effective position sizing, stop-loss placement, and diversification minimize losses and optimize returns.

Psychological Resilience – Handling losing streaks, drawdowns, and emotional setbacks is part of a trader's journey.

The Importance of Risk Management

A disciplined risk management approach ensures traders remain in the game for the long haul. Essential techniques include:

Setting stop-loss orders to limit potential losses.

Calculating risk-to-reward ratios to optimize trade outcomes.

Avoiding over-leveraging, which can lead to significant financial setbacks.

Trading Courses Online: The Best Way to Learn

For those interested in mastering day trading, enrolling in trading courses online is an excellent way to build knowledge and skills. These courses cover:

Technical analysis and chart reading

Order execution and market depth

Strategy development and risk control

In trading courses Australia, students gain hands-on experience through real-time market simulations and one-on-one mentorship. Live market trading allows traders to see strategies in action, refine their techniques, and improve their decision-making process.

Final Thoughts

Day trading is not just about making quick profits—it requires dedication, persistence, and continuous learning. By focusing on trading learning, refining strategies, and implementing robust risk management techniques, traders can navigate the markets with confidence. If you're ready to take the next step in your trading journey, consider enrolling in a day trade training program to build a solid foundation for success.