n Yes, there are several alternatives to low-credit loans, similar to borrowing from family or friends, looking for credit score counseling, or wanting into peer-to-peer lending platforms.

n Yes, there are several alternatives to low-credit loans, similar to borrowing from family or friends, looking for credit score counseling, or wanting into peer-to-peer lending platforms. Shopping around for personal loans from credit unions can also yield higher phrases. Exploring grants or assistance programs may be helpful, relying in your circumstan

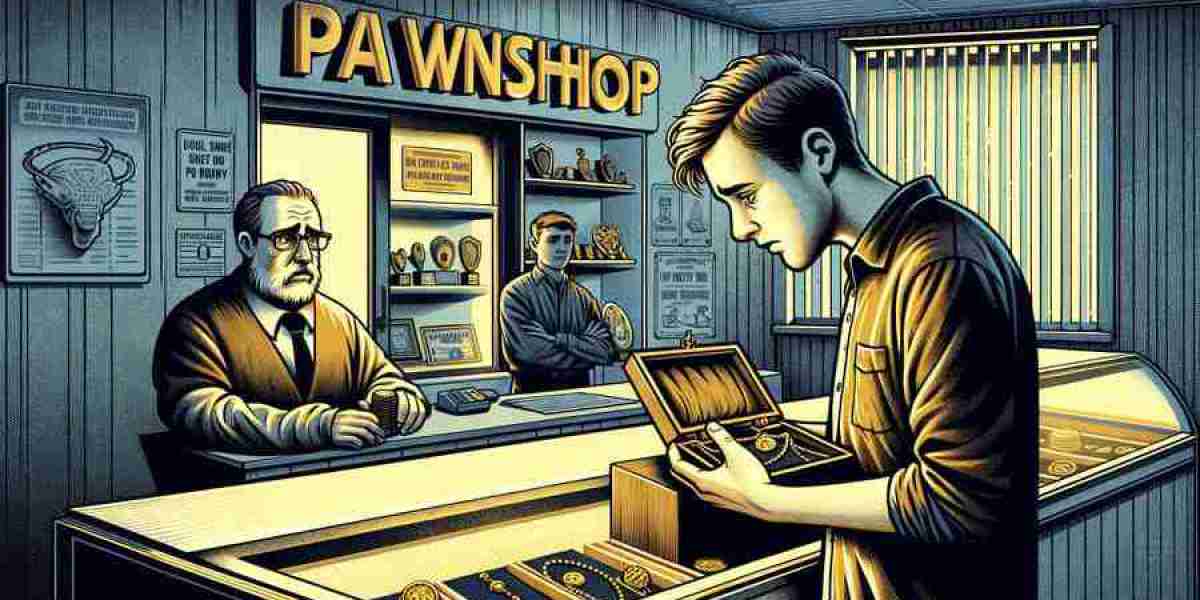

How Does the Pawnshop Loan Process Work?

Obtaining a pawnshop mortgage includes a quantity of steps. Firstly, the borrower takes an merchandise of value to a pawnshop, where a pawn broker assesses it. The evaluation encompasses the quality, situation, and market demand for the merchandise. Based on this evaluation, the broker provides a mortgage amount, and if the borrower agrees, a pawn ticket is iss

The Role of 베픽 in Loan Research

베픽 serves as a comprehensive platform providing detailed evaluations and details about low-credit loans. By visiting 베픽, customers can examine mortgage products, consider interest rates, and examine customer experiences with different lenders. This valuable resource empowers debtors by providing essential data to make informed selections about their fu

Additionally, it's essential for companies to take care of compliance with local and federal legal guidelines governing lending practices. This compliance not solely protects the group but in addition assures employees they're coming into a good lending agreement. A sturdy coverage framework contributes to an total constructive worker experience and financial well-be

Improving Your Credit Score

While low-credit loans present immediate financial relief, people must also concentrate on methods to improve their credit scores over time. Paying off existing money owed, making timely invoice payments, and disputing any inaccuracies on credit stories can all contribute to a more healthy credit profile. Additionally, accountable utilization of recent credit score can positively impact scores, main to higher mortgage opportunities in the fut

Evaluating Your Need for Additional Loans

Before making use of for an extra

Mobile Loan, it is crucial to carry out an intensive analysis of your monetary situation. Begin by assessing your current debts, income, and expenses to discover out whether taking up extra debt is a smart determinat

Repayment Structures of Employee Loans

Most employee loans are repaid through automatic deductions from the employee's paycheck, making it important for debtors to arrange for these deductions in their budgeting. The reimbursement structure is typically established earlier than the loan is disbursed, permitting

Loan for Housewives employees to understand their monetary commitments clea

Collectibles, corresponding to uncommon coins, artwork, and vintage gadgets, can usher in substantial loan quantities, particularly if they are in good condition. Firearms and musical instruments are also common. Borrowers ought to remember that the condition and demand for the item will greatly affect the mortgage quantity provided by the pawns

Potential Drawbacks of Pawnshop Loans

Despite their advantages, pawnshop loans do have several potential drawbacks that debtors should consider. High-interest charges are a major concern, typically reaching ranges that may be difficult to handle, particularly for larger loans. If the mortgage isn't repaid, debtors danger shedding valuable gadgets permanen

Yes, many lenders specializing in same-day loans are extra versatile with credit scores. While a low credit score could affect the phrases of your mortgage, particularly interest rates, there are options obtainable for debtors with less-than-perfect credit. It's necessary to research lenders' insurance policies and find choices that suit your monetary situat

To successfully handle repayments, create a price range that features your mortgage payment alongside your different expenses. Setting up automatic payments might help keep away from missed payments. Additionally, think about making additional funds when potential to minimize back the principal steadiness sooner, which can save on interest costs over t

Risks Associated with Additional Loans

While further loans include benefits, they don't appear to be with out dangers. One main concern is the accumulation of debt. Borrowers might find themselves in precarious monetary situations in the occasion that they take on extra debt than they'll manage, resulting in monetary strain or defaulting on lo

Another potential concern is the emotional attachment people might have to their belongings. Some might find it difficult to part with items of personal significance, even quickly. Additionally, if a borrower doesn't fully perceive the terms, they may find themselves in a scenario where the loan turns into unmanageable, leading to additional monetary distr

With a give consideration to making certain patrons are well-informed about their choices, BePick aims to empower users with knowledge in regards to the dangers and benefits related to pawnshop loans. Whether you might be considering pawning an merchandise or just looking for to study extra, BePick is designed to assist you at each stage, making the pawnshop mortgage experience much less daunting and extra managea

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till 3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till 1Win No-Deposit Promo: Quick Betting Rewards in 2025

1Win No-Deposit Promo: Quick Betting Rewards in 2025