When to Use a Loan Calculator

Using a loan calculator should be a foundational step before committing to any loan.

When to Use a Loan Calculator

Using a loan calculator should be a foundational step before committing to any loan. It's particularly useful through the early levels of researching mortgage options when comparing various lenders or mortgage produ

Another challenge may be the notion of your business's viability. Startups usually wrestle to secure loans as they lack a observe document. In such circumstances, making ready a robust marketing strategy that outlines projected development, market analysis, and financial forecasts can enhance your credibility with lend

n To apply for a enterprise mortgage, key paperwork usually include monetary statements, tax returns, a comprehensive marketing strategy, and your personal credit history. Additional documentation could also be required primarily based on the lender, including financial institution statements and proof of collateral if applying for a secured l

Whether or not employee loans are worth it depends on particular person circumstances. For many workers, the accessibility and favorable phrases make these loans a priceless financial software. They can stop people from falling right into a cycle of high-interest debt and supply essential funds during urgent situati

It's crucial to discover all choices earlier than committing to an unemployed mortgage. Assess your financial state of affairs, consider the phrases of the

24-Hour Loan, and understand potential impacts in your monetary future. Making well-informed decisions is crucial to curb any drastic penalties down the l

What is a Loan Calculator?

A mortgage calculator is a complicated tool designed to assist debtors in estimating their loan funds and curiosity over the life of the mortgage. By inputting variables similar to loan quantity, rate of interest, and time period, customers obtain prompt calculations that may help visualize their financial commitments. This predictive capability allows individuals to experiment with different eventualities, adjusting variables to see how they have an effect on total pri

Emergency loans can present fast monetary assistance in unexpected situations, helping people bridge the gap till they regain financial stability. Whether it's a medical invoice, automotive restore, or pressing home maintenance, emergency loans can mitigate the stress that comes with sudden expenses. This article will delve into the small print of emergency loans, how they work, their pros and cons, and the indispensable position of resources like 베픽 in navigating the mortgage landsc

Additionally, providing monetary counseling as part of the loan program might help make positive that employees understand their rights and responsibilities when borrowing. Such transparency not solely protects the group legally but additionally fosters a tradition of trust and resp

Understanding Real Estate Loans

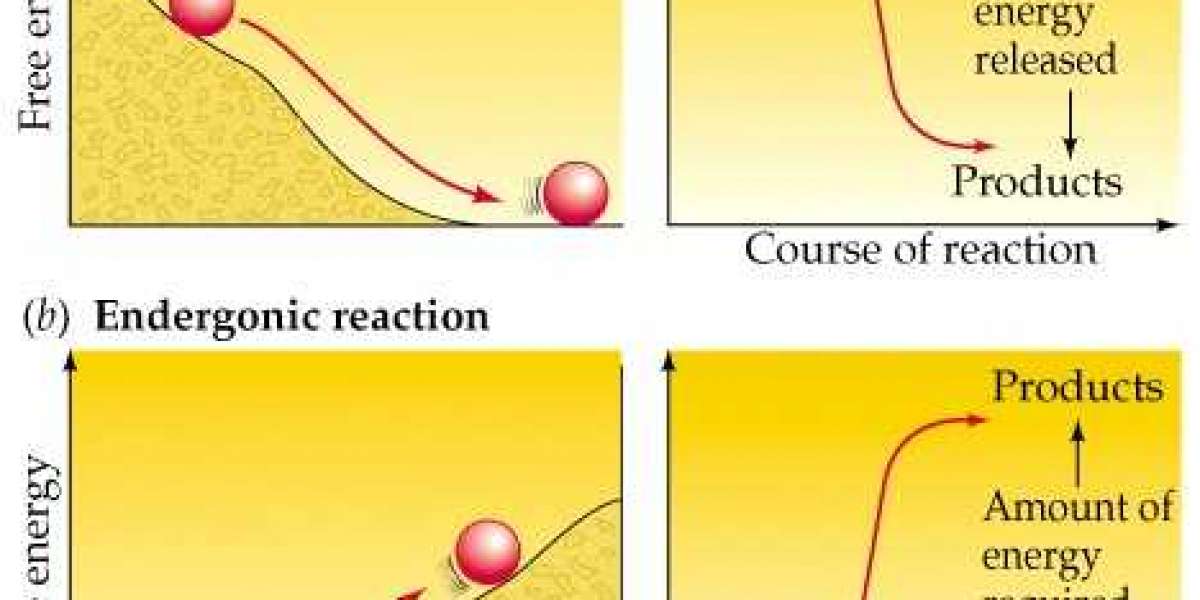

Real property loans are essentially *secured loans* that are used to buy property. The property itself serves as collateral, which implies that if the borrower defaults, the lender can reclaim the property. Most actual property loans include specific terms, including the length of compensation and the interest rates. It's crucial for potential debtors to understand these parts as they significantly have an result on the affordability of their l

베픽 is especially helpful for evaluating totally different calculators, understanding varied mortgage phrases, and accessing consumer critiques. These features make it simpler for debtors to select the proper calculator tailored to their particular wants, bettering their monetary decision-making proc

Additionally, loan calculators may be valuable tools throughout refinancing purposes, helping debtors decide whether their present loans are still the most suitable choice. By recalculating potential financial savings and advantages, people can make extra knowledgeable selections relating to

이지론 their financial fut

In conclusion, employee loans function a crucial monetary support mechanism in the office. By understanding their operate, advantages, and the mechanisms concerned, each workers and employers can engage with these merchandise more successfully, resulting in a more harmonious and productive work environm

Payday loans are sometimes simpler to obtain but can carry exorbitant rates of interest. These are short-term loans meant to cowl urgent expenses but can result in a cycle of debt if not managed correctly. Secured loans require collateral, similar to a automobile or financial savings account, which reduces the chance for lenders but puts your belongings in danger if you fail to re

Emergency loans are usually simpler to acquire than traditional loans, as many lenders have relaxed credit requirements and easy application processes. However, debtors ought to nonetheless be cautious and guarantee they perceive loan terms and rates of interest earlier than committ

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till 3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos