In the fast-paced world of finance, where split-second decisions can make or break fortunes, the ability to predict stock market movements with precision is a coveted skill. Traditional methods of stock analysis rely heavily on historical data, technical indicators, and fundamental analysis. However, with the advent of artificial intelligence (AI), a new era of stock prediction has emerged, promising unparalleled accuracy and efficiency.

AI for stock prediction leverages sophisticated algorithms and machine learning techniques to analyze vast amounts of data, including historical price movements, trading volumes, market sentiments, news articles, social media trends, and more. Unlike human analysts, AI models can process and interpret this data at a speed and scale that is simply beyond human capability, leading to more informed and timely investment decisions.

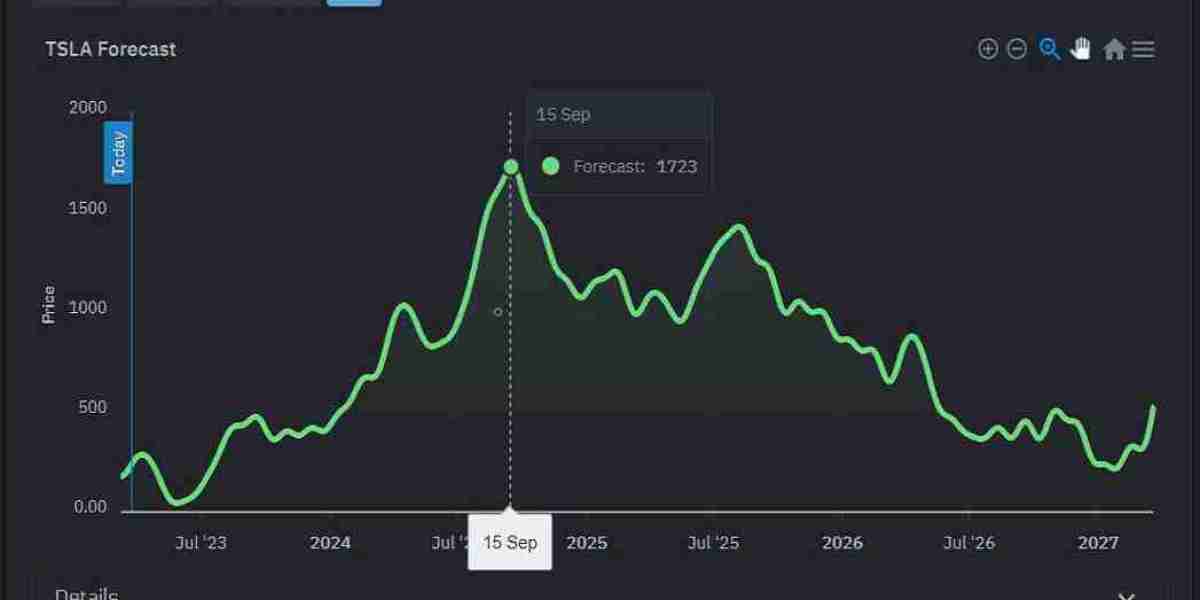

One of the key advantages of Apple Stock Price Forecast is its ability to identify complex patterns and correlations within data that may elude human analysts. Traditional quantitative models often struggle to capture nonlinear relationships and subtle market dynamics. In contrast, AI algorithms excel at recognizing these patterns, enabling them to generate more accurate forecasts and anticipate market trends with greater confidence.

Moreover, AI-powered stock prediction systems are adaptive and self-learning. As they analyze new data and receive feedback on the accuracy of their predictions, these models continuously refine their algorithms, improving their performance over time. This iterative learning process allows AI systems to adapt to changing market conditions and evolving investor behavior, making them invaluable tools for navigating volatile and unpredictable markets.

Several approaches to AI-based stock prediction have emerged, each with its own strengths and limitations. Machine learning techniques such as neural networks, support vector machines, and random forests have been widely used to build predictive models that can forecast stock prices, identify trading opportunities, and manage investment portfolios. Deep learning, a subset of machine learning that uses neural networks with multiple layers, has shown particular promise in capturing complex patterns in financial data.

In addition to price prediction, AI is also being applied to other areas of stock market analysis, such as risk management, sentiment analysis, and anomaly detection. Natural language processing (NLP) algorithms, for example, can analyze news articles, earnings reports, and social media posts to gauge market sentiment and identify emerging trends or market-moving events. By incorporating these insights into their models, AI-driven trading systems can make more informed decisions and react swiftly to changing market conditions.

Despite the immense potential of AI for stock prediction, it is not without its challenges. Building accurate and reliable predictive models requires high-quality data, robust algorithms, and careful validation techniques. Overfitting, data snooping, and model biases are common pitfalls that must be addressed to ensure the integrity of AI-driven investment strategies. Moreover, the inherent complexity of financial markets means that even the most advanced AI models may struggle to outperform the market consistently.

In conclusion, AI has revolutionized the field of stock prediction, offering investors unprecedented insights into market dynamics and opportunities. By harnessing the power of machine learning, deep learning, and natural language processing, AI systems can analyze vast amounts of data, uncover hidden patterns, and make informed predictions about future price movements. While challenges remain, the potential benefits of AI for stock prediction are too significant to ignore, heralding a new era of data-driven investing.