n Before taking an internet loan, think about the interest rates, repayment terms, and potential charges. It's also necessary to assess your current financial scenario and the impact of compensation in your finan

Moreover, many payday mortgage lenders function on-line, which simplifies the borrowing course of. Consumers can apply from the consolation of their houses, eliminating the necessity for in-person visits. This comfort can save useful time, particularly for those with busy schedules or transportation challen

In at present's fast-paced financial panorama, many people find themselves in want of quick money for unexpected bills. Fast payday loans are designed to offer a quick financial solution, allowing borrowers to address emergencies with out extensive delays. This article delves into the nuances of fast

Personal Money Loan payday loans, together with their options, pros and cons, and the place to search out dependable data. One such resource is the BePick website, where customers can discover comprehensive data and critiques on quick payday loans, empowering them to make knowledgeable financial selecti

n Yes, many payday lenders do not conduct extensive credit score checks, making it potential to obtain a mortgage even with bad credit. However, understanding the upper rates of interest and potential risks involved is crucial earlier than proceeding with a payday l

Typically, applicants need a steady source of revenue and have to be a minimal of 18 years old. The quantity borrowed usually ranges from a couple of hundred to a thousand dollars, relying on the lender's coverage. Repayment terms are typically brief, with most loans due inside two to 4 we

Tips for Using Fast Payday Loans Wisely

To use fast payday loans correctly, it is important to ascertain a clear reimbursement plan before borrowing. Calculate your budget to find out how a lot you probably can afford to repay in your subsequent payday, guaranteeing that the mortgage suits inside your financial capabilit

There are numerous kinds of on-line loans available to students, every designed to fulfill completely different financial wants. One of the most common varieties is the federal scholar

Car Loan, which is funded by the federal government. These loans usually have decrease interest rates and extra favorable repayment terms compared to private loans. They are available in sponsored and unsubsidized types, with the former offering curiosity assistance while college students are enrolled in sch

Finding dependable details about on-line loans is essential for making informed choices. Websites like 베픽 provide in depth assets, including detailed reviews of lenders, comparisons of charges, and suggestions for debtors. Such platforms serve as priceless instruments for understanding the intricacies of online borrow

By visiting Bepex, users can entry professional insights on lenders, repayment phrases, and the overall borrowing course of. This platform emphasizes the significance of understanding the risks associated with payday loans and encourages accountable borrowing practi

Understanding

Loan for Delinquents Types and Options

There are varied kinds of loans obtainable by way of on-line lenders, every catering to different wants. Personal loans are among the most common, offering funds for particular expenses such as medical payments, residence enhancements, or debt consolidation. Understanding the aim of the mortgage helps in selecting the right firm and phra

Why Research Matters in Online Lending

Engaging in thorough research is imperative when trying to find online loan companies. The proper strategy could make the distinction between a optimistic borrowing experience and a difficult encounter. The wealth of data available right now permits consumers to teach themselves in regards to the lending landsc

To start with, a dependable online loan company sometimes has a transparent and clear application course of. Customers ought to be succesful of find detailed data on interest rates, phrases of repayment, and costs associated with the mortgage. A respected lender won't ever ask for upfront charges before processing a loan applicat

Additionally, not all payday lenders function transparently. Some might have hidden charges, aggressive assortment practices, or unclear terms, making it essential for borrowers to conduct thorough analysis earlier than selecting a lender. Always read the fine print and understand all terms associated with any payday mortgage agreem

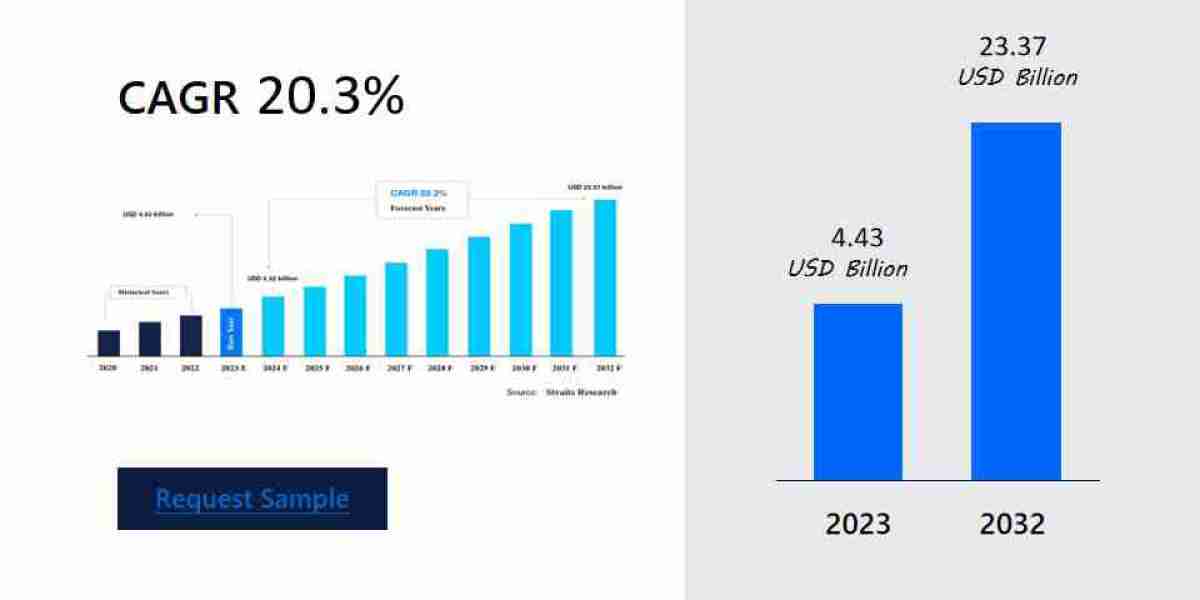

The Rise of Online Lending

Online lending has considerably modified the greatest way folks method personal and business financing. The comfort of applying for loans from the consolation of residence has attracted many debtors, however it has additionally led to an increase in fraudulent actions. As such, it’s important to grasp the traits of safe online mortgage fi

Knowing When to Use Payday Loans Online

Payday loans may be helpful in specific conditions, notably when faced with surprising expenses corresponding to medical emergencies, automotive repairs, or overdue bills. However, it's essential to assume about whether this selection aligns along with your total monetary strategy. Before deciding to go for a payday mortgage, evaluate your monetary scenario and explore alternati

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till

Jiliko Login: Your Gateway to a Premier Online Casino Experience in Pakistan

By Hannah Till 3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till