AI in Finance: Strengthening Compliance, Anti-Money Laundering, and Audit Preparation

In today’s financial world, compliance with regulations, preventing financial crimes, and preparing for audits are essential for maintaining business integrity and avoiding significant penalties. However, these processes can be both time-consuming and complex, requiring substantial resources and attention to detail. Artificial intelligence (AI) is revolutionizing how businesses approach finance compliance, anti-money laundering (AML), and audit preparation. AI-driven solutions are not only automating these tasks but also providing greater accuracy, reducing risks, and improving operational efficiency. In this article, we will delve into how AI agents are transforming finance compliance, AML practices, and audit preparation.

AI for Finance Compliance: Streamlining Regulatory Adherence

Finance compliance is crucial for ensuring that businesses adhere to a wide range of local, national, and international regulations. These rules are designed to protect businesses, customers, and stakeholders from financial malpractice, fraud, and other financial risks. However, staying compliant can be challenging, especially for organizations that deal with large volumes of data and operate across multiple jurisdictions.

How AI Enhances Finance Compliance

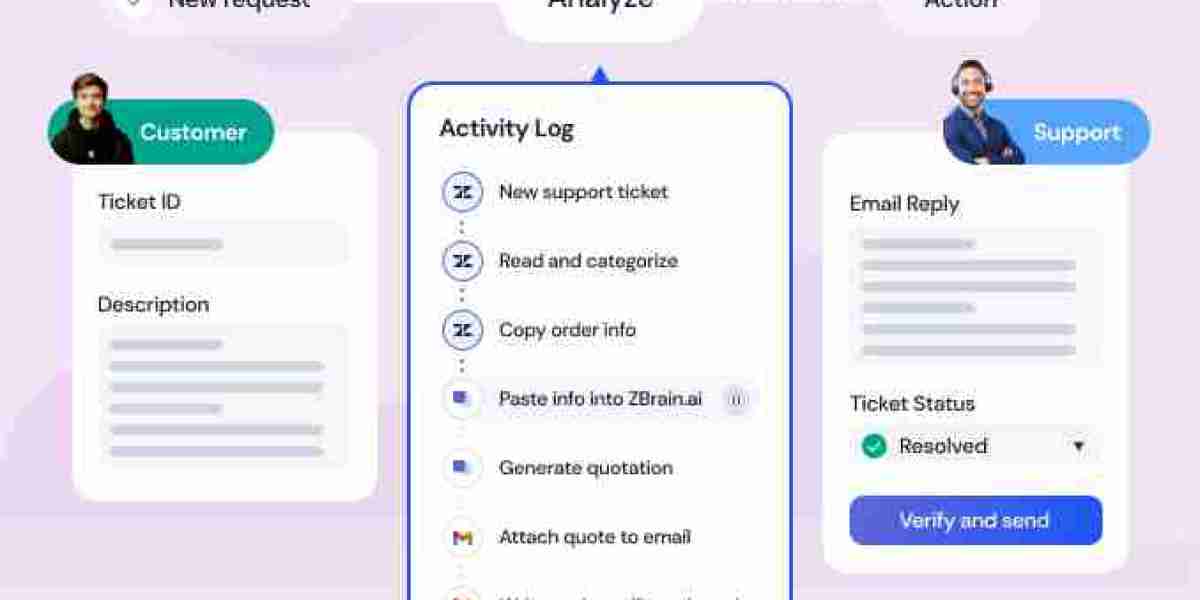

The AI agent for Finance Compliance automates many of the tasks involved in ensuring regulatory compliance. By leveraging AI, businesses can improve the efficiency and accuracy of their compliance processes, reducing the chances of human error and ensuring that regulations are always met.

Automated Compliance Monitoring: AI agents continuously monitor business activities to ensure they align with industry regulations. By scanning transactions, financial statements, and other business operations, AI can quickly identify any discrepancies or potential compliance issues, flagging them for further review.

Real-Time Compliance Checks: With AI, compliance checks happen in real-time, meaning businesses are alerted as soon as a potential breach occurs. This allows companies to address issues immediately, reducing the likelihood of violations and ensuring they stay ahead of changing regulatory requirements.

Data-Driven Insights: AI processes large amounts of data quickly and efficiently, extracting meaningful insights that help businesses understand their compliance status. With AI-driven reports, businesses can get a clear picture of their compliance efforts and take proactive measures if necessary.

Efficient Reporting and Documentation: AI tools automate the preparation of compliance reports, ensuring they are complete and accurate. This reduces the manual effort required for reporting and helps companies stay on top of filing deadlines.

By automating compliance-related tasks, AI helps businesses maintain continuous compliance without the need for constant manual oversight. This not only saves time but also reduces the risks associated with regulatory violations.

AI for Anti-Money Laundering (AML): Detecting and Preventing Financial Crimes

Money laundering is a serious financial crime that involves concealing the origins of illegally obtained money. Businesses must take proactive steps to prevent money laundering and adhere to anti-money laundering (AML) regulations, which require them to monitor transactions and report suspicious activity. Failure to do so can result in severe legal consequences, including fines, sanctions, and reputational damage.

How AI Strengthens AML Practices

The AI agent for Anti-Money Laundering uses advanced algorithms to detect and prevent money laundering activities by monitoring financial transactions in real-time. Here’s how AI is enhancing AML efforts:

Real-Time Transaction Monitoring: AI constantly monitors transactions, analyzing patterns and identifying suspicious activity that could indicate money laundering. By doing so in real-time, AI ensures that any irregularities are flagged immediately, preventing financial crimes from going unnoticed.

Pattern Recognition: Machine learning algorithms allow AI systems to identify patterns that might not be immediately apparent. These patterns could be indicative of money laundering schemes, such as large, unusual transactions or activity that doesn’t align with a customer’s typical behavior.

Risk-Based Approach: AI can assess the risk level of different customers or transactions, allowing businesses to prioritize high-risk activities for further investigation. This makes AML efforts more targeted and efficient, reducing the amount of false positives.

Regulatory Compliance: AI tools help businesses comply with global AML regulations by ensuring that all required checks are completed. With continuous monitoring, AI agents can alert businesses to any non-compliant activities and help them take swift action.

By automating transaction monitoring and providing real-time alerts, AI improves the effectiveness of AML programs, reduces the risk of financial crimes, and helps businesses stay compliant with ever-evolving regulatory requirements.

AI for Audit Preparation: Simplifying the Audit Process

Preparing for an audit can be an overwhelming process for businesses, especially when large volumes of financial data need to be reviewed. Traditional audit preparation requires significant manual effort to organize and analyze financial records, often leading to delays, inaccuracies, and missed deadlines. However, AI is changing the way businesses prepare for audits, automating many of the tasks involved and providing more accurate, comprehensive audit reports.

How AI Transforms Audit Preparation

The AI agent for Audit Preparation simplifies the audit process by automating key tasks such as data gathering, report generation, and compliance verification. This reduces the time and effort required to prepare for an audit while improving accuracy and reducing the risk of human error.

Automated Data Collection: AI agents gather and organize the necessary financial data for audits, ensuring that everything is in order before the audit begins. This includes scanning financial records, transaction histories, and compliance documentation.

Error Detection: AI-powered tools can quickly analyze financial data for discrepancies, inaccuracies, or incomplete records, identifying potential issues before the auditor arrives. This ensures that businesses can address any problems in advance, improving the likelihood of a smooth audit.

Real-Time Updates: As businesses continue to perform transactions, AI agents can update audit-related information in real time, making it easier for auditors to access the latest data. This ensures that the audit process reflects the most current financial information.

Improved Reporting: AI tools help generate comprehensive, detailed reports for auditors, highlighting areas that require attention and providing supporting documentation. This streamlines the audit process and makes it easier for auditors to review financial records.

By automating audit preparation, AI reduces the stress and complexity of preparing for an audit, ensures compliance with regulatory standards, and improves the overall accuracy and efficiency of the audit process.

Conclusion: The Future of Financial Compliance, AML, and Audit Preparation with AI

AI is revolutionizing how businesses approach financial compliance, anti-money laundering, and audit preparation. By automating key tasks, AI ensures that businesses stay compliant with regulations, detect and prevent financial crimes, and prepare for audits with greater accuracy and efficiency. AI not only saves time but also reduces the risk of errors, fraud, and non-compliance, allowing businesses to focus on their core operations while maintaining high standards of financial integrity.