Common Misconceptions about Housewife Loans

Despite the rising popularity of housewife loans, several misconceptions can deter girls from pursuing them.

Common Misconceptions about Housewife Loans

Despite the rising popularity of housewife loans, several misconceptions can deter girls from pursuing them. One prevalent fable is that only girls with excessive incomes can qualify. This view could be deceptive, as lenders now recognize a big selection of components when evaluating functi

Repayment Strategies for Emergency Loans

Creating a stable reimbursement strategy is vital for managing an Emergency Fund Loan. Start by budgeting for the monthly funds as soon as you safe the mortgage. This proactive method will help you avoid falling beh

Understanding Additional Loans

Additional Loans serve as an extra layer of financial help for individuals or companies trying to leverage their present credit score. These loans can be particularly helpful for those who need immediate funds without going by way of the lengthy strategy of applying for a new loan. Essentially, an

Additional Loan builds on top of existing debt, enabling borrowers to access more financing underneath sure situati

One of the key features of Housewife Loans is that they often contemplate elements past traditional credit scores. Financial institutions could take into account the general management of household funds and the ability to repay based on household income. This inclusivity makes it simpler for housewives to acquire loans without being tethered to a formal employment stand

How to Build Your Emergency Fund

While Emergency Fund

Other Loans might help in instant conditions, building your individual emergency fund is a long-term solution that can forestall reliance on loans. Start by setting clear savings targets primarily based on potential expen

Selecting the best lender involves comprehensive research and comparability of interest rates, terms, and borrower evaluations. BePick is a incredible software that aggregates this information, making it simpler to gauge various lenders based mostly on real experiences and monetary informat

Another essential facet is the borrower's credit history. While Housewife Loans are sometimes extra accessible to those with limited credit score, having a good credit score rating can enhance the probabilities of receiving a mortgage with better terms. Additionally, lenders could inquire in regards to the household's overall income to evaluate repayment capac

In at present's monetary landscape, securing an Additional Loan can considerably impact your budget and future investments. Whether you want funds for unexpected bills, education, or residence enhancements, understanding Additional Loans is important. This article explores the nuances of Additional Loans, their benefits, and tips on how to navigate them effectively. We'll additionally introduce BePick, a useful resource for insights and evaluations on Additional Loans, empowering you to make knowledgeable financial decisi

Once you've selected a lender, you will sometimes have to fill out an online utility kind. Make sure to organize necessary paperwork, including proof of income, identification, and detailed info relating to your freelancing actions. This information won't solely help your software but in addition provide a clearer picture of your monetary situation to the len

By accessing BePick, housewives can compare completely different mortgage choices, learn real user evaluations, and acquire insights into how to manage their loans effectively. This can lead to higher monetary planning and improved administration of non-public fu

Once you determine the mortgage quantity you wish to borrow, you will want to request the money advance or mortgage through the suitable channels. This can normally be accomplished online or by way of customer service. Ensure that you've got all necessary information at hand, together with your identification and monetary details as required by the len

Potential Risks Involved

Like any financial product, Housewife Loans include their very own set of risks. Borrowers should be cautious of high-interest rates, which might lead to monetary pressure if not managed properly. It's essential to have a reimbursement plan to keep away from defaulting on the l

This type of mortgage can vary by way of rates of interest and compensation terms, usually depending on the lender's insurance policies and the borrower's creditworthiness. Since Card Holder Loans are sometimes issued by credit card companies or banks, the process is mostly quick and handy, allowing debtors to manage their finances successfully while ensuring that they meet their obligations without additional monetary str

Common Pitfalls to Avoid

While Freelancer Loans could be extremely beneficial, there are frequent pitfalls to keep away from. One of probably the most important risks is over-borrowing, which might result in overwhelming debt. It's important to evaluate your financial situation accurately and only borrow what you'll have the ability to comfortably re

3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

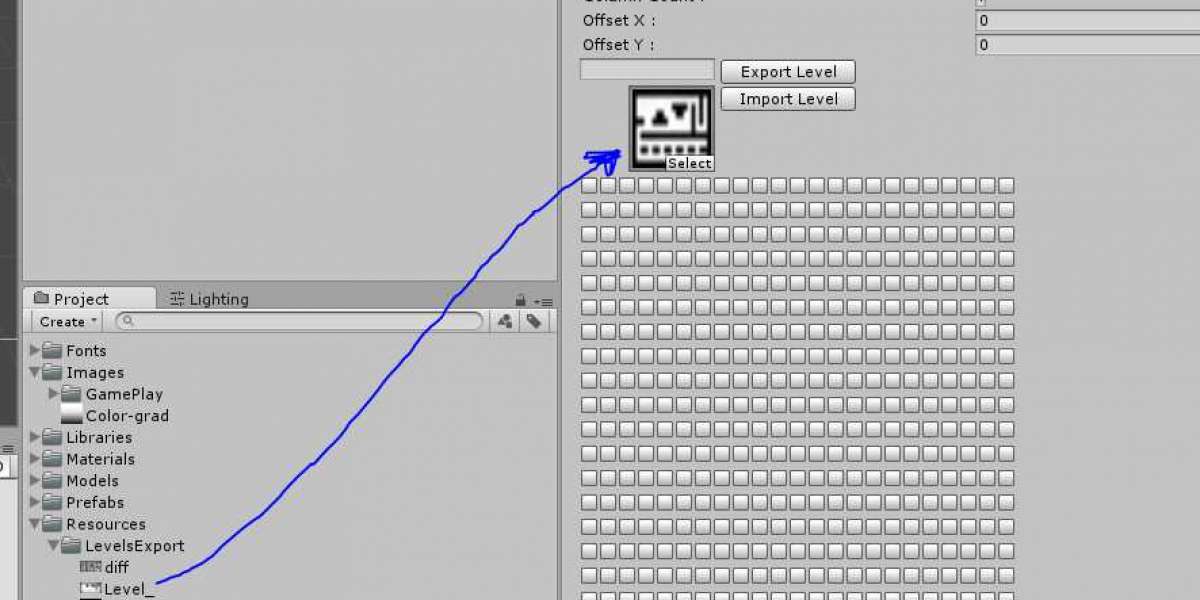

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till Choosing the Best Austin Video Production Agency: A Comprehensive Guide

By Hannah Till

Choosing the Best Austin Video Production Agency: A Comprehensive Guide

By Hannah Till