- **Time-saving**: By inputting data into an internet calculator, users can quickly find their expected monthly payments without painstaking manual calculations.

- **Time-saving**: By inputting data into an internet calculator, users can quickly find their expected monthly payments without painstaking manual calculations. This hastens the process of shopping round for lo

Users can discover a wealth of details about interest rates, utility processes, and lender comparisons, guaranteeing they make well-informed selections appropriate for his or her monetary situations. By utilizing the resources out there on 베픽, debtors can improve their information and navigate the complexities of debt consolidation with confidence and clar

Lastly, accumulating multiple unsecured loans can lead to financial pressure, as borrowers may find themselves juggling numerous funds. This state of affairs can shortly escalate right into a debt cycle if not managed effectively, making it important for borrowers to evaluate their financial capabilities before committing to any l

Finally, contemplate the aim of the mortgage. Identify whether you want a lump sum for a specific expense or a line of credit for ongoing wants. Different lenders cater to different necessities, so being clear about your goals will allow you to select the most suitable unsecured l

A

Daily Loan mortgage is a short-term monetary product designed to provide quick entry to money for sudden bills or emergencies. The application course of is usually fast and straightforward, allowing users to receive funds within a day. However, you will want to review the associated rates of interest and reimbursement schedules carefully to keep away from financial pitfa

Furthermore, it’s essential to understand the lender’s insurance policies relating to reimbursement flexibility. Some lenders supply grace intervals or options for extending the

Real Estate Loan time period, which could be beneficial during monetary hardships. Always learn customer agreements thoroughly and never hesitate to ask questions if any terms are unclear. Your monetary security is of utmost significa

What Are Emergency Loans?

Emergency loans are short-term financial options designed to help people in pressing situations needing instant funds. They typically come with fast approval processes, enabling debtors to entry cash inside a day or two. These loans can come from various sources, together with traditional banks, credit score unions, and online lenders. Unlike typical loans, the application process for emergency loans is often streamlined to accommodate borrowers' immediate monetary ne

Moreover, having an unsecured mortgage also can help improve one's credit score rating if funds are made constantly and on time. Responsible borrowing behavior demonstrates financial reliability, which may improve creditworthiness over time and potentially unlock better mortgage phrases sooner or la

Besides interest rates, borrowers must also take observe of additional fees that will apply, similar to origination charges, late cost charges, or penalties for early reimbursement. Each lender might have completely different constructions regarding these fees, so it's essential to scrutinize the nice print earlier than making any commitments. Ignoring these terms could lead to sudden costs in the fut

While unemployed loans can suffice for some, numerous alternate options exist that may current less financial pressure. For people experiencing short-term unemployment, exploring neighborhood assist applications can be useful. Many organizations provide assistance with masking instant bills like utilities or r

How to Choose the Right Provider

When seeking a every day mortgage, selecting the proper supplier is important to ensure favorable phrases. Start by researching numerous lenders, comparing interest rates and compensation situations. Utilize online assets and evaluations to gauge lender popularity and customer experiences. A reliable lender ought to provide clear info concerning the mortgage phrases and be transparent about any fees invol

Another error is treating consolidation as a blanket solution without addressing underlying monetary habits. Merely consolidating your debt and not utilizing a strong price range and spending plan can result in accumulating more debt after consolidat

Another benefit is the comparatively lenient eligibility standards. Many lenders do not require an ideal

Credit Loan score, making these loans accessible to a broader vary of individuals. Additionally, emergency loans can even assist enhance credit score scores if repaid on time, offering a strategic benefit past the immediate w

The website options content that explains the intricacies of mortgage sorts, software processes, and potential pitfalls, making certain users are equipped with the mandatory knowledge. This wealth of knowledge permits people to navigate the borrowing panorama with confidence, assessing options from multiple lenders and finding the most effective solutions tailored to their wa

Daily loans provide a convenient monetary answer for these facing immediate money move challenges. With quick access to short-term funds, these loans cater to numerous wants ranging from emergency expenditures to unexpected payments. Whether you wish to cover unforeseen medical bills or dealing with urgent house repairs, daily loans can be a lifesaver. However, as the demand for such financial merchandise rises, it’s crucial to know the ins and outs of daily loans, making certain you make knowledgeable decisions when seeking help. To assist you to navigate this landscape, we introduce Be Pick, a website dedicated to offering complete info and insightful reviews on daily lo

3D Printing Services in Coimbatore: Book Your Service Today

3D Printing Services in Coimbatore: Book Your Service Today

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

GPS Tracker for Bike: Fleettrack’s Top Choice for Riders

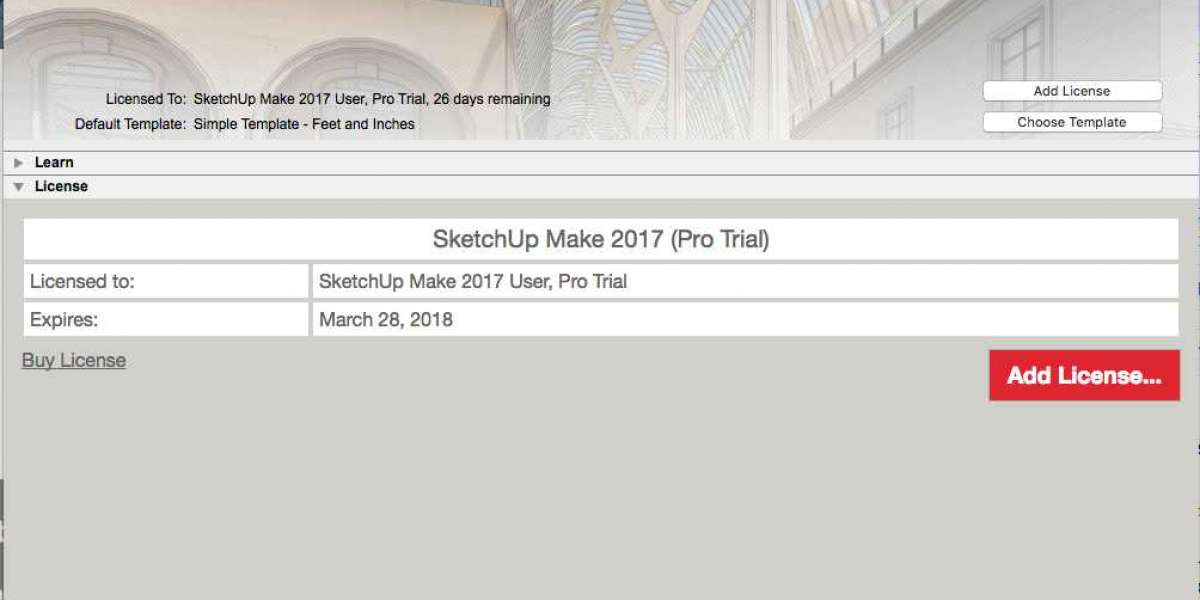

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Adobe Pho Shop 7.0 For Activator Torrent File 64 Macos

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till

Discover the Excitement of BouncingBall8 APK: Your Ultimate Guide

By Hannah Till Choosing the Best Austin Video Production Agency: A Comprehensive Guide

By Hannah Till

Choosing the Best Austin Video Production Agency: A Comprehensive Guide

By Hannah Till